Adani Enterprises Q3 Results: Adani Enterprises reported Q3 Results on February 14, 2023. The company reported a consolidated net profit of Rs 820 crore for the Decemberquarter, against a net loss of Rs 11.63 crore crores in the corresponding quarter of the previous year.

Revenue from Operations jumped 42% YoY to Rs 26,612.20 crore from Rs 18,757.90 crore in Q3 FY22.

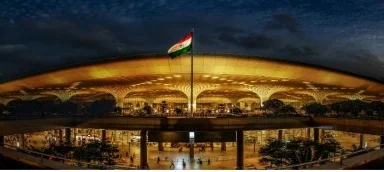

During the quarter, Adani Airports handled 20.3 million passengers (an increase of 40 percent YoY), 142,000 air traffic movements (an increase of 21 percent YoY), and 1.8 lakh MT cargo.

Highlights of Adani Enterprises Q3 Results

| Segments | Q3FY23 | Q3FY22 |

| Revenue from Operations | 26,612 crores | 18,758 crores |

| Net Profit for the Quarter | 820 crores | (11.63 crores) |

| EBITDA | 1,968 crores | 979 crores |

| EBITDA margin | 6.1% | 4.1% |

Revenue from Operations (Adani Enterprises Q3 Results)

Adani Enterprises reported its Revenue from Operations up 42% YoY to Rs 26,612.20 crore from Rs 18,757.90 crore in the corresponding quarter of the previous year.

Total Income also rose by 42% YoY to 36,950.83 crores from Rs 18963.40 crores in the corresponding quarter of the previous year.

The stock of Adani Enterprises ended nearly 1.88% up on the NSE on Friday.

Net Profit for the Quarter (Adani Enterprises Q3 Results)

Adani Enterprises reported a consolidated net profit of Rs 820.06 crore for the December quarter, against a net loss of Rs 11.63 crore crores in the corresponding quarter of the previous year.

Net profit also jumped by 78% QoQ from 460.94 crores.

“Our success is due to our strong governance, strict regulatory compliance, sustained performance, and solid cashflow generation. The current market volatility is temporary; AEL will continue to work with the twin objectives of moderate leverage and looking at strategic opportunities to expand and grow,” Adani Group Chairman Gautam Adani said.

EBITDA & margin (Adani Enterprises Q3 Results)

Adani Enterprises reported its EBITDA zoomed 101% YoY to Rs 1,968 crore from Rs 979 crore in the corresponding quarter of the previous year.

The company reported its EBITDA margin improved to 61% YoY from 4.1% in the corresponding quarter of the previous year.

“Our fundamental strength lies in mega-scale infrastructure project execution capabilities, organizational development and exceptional O&M management skills comparable to the best in the world,” Adani Group Chairman Gautam Adani said.

New energy vertical (Adani Enterprises Q3 Results)

Adani Enterprises reported in the new energy vertical, the company saw solar modules’ volume increase by 63% to 430 MW. In the mining business, production volume stood at 6.2 million tonnes.

Adani Enterprises reported Integrated resource management business reported a 38% YoY growth in revenue to Rs 17,595 crore.

Company Outlook (Adani Enterprises Q3 Results)

“Our fundamental strength lies in mega-scale infrastructure project execution capabilities, organizational development and exceptional O&M management skills comparable to the best in the world,” Adani Group Chairman Gautam Adani said.

“Our success is due to our strong governance, strict regulatory compliance, sustained performance, and solid cashflow generation. The current market volatility is temporary; AEL will continue to work with the twin objectives of moderate leverage and looking at strategic opportunities to expand and grow,” he said.

Read more:

Nykaa Q3 Results: Profit declines 68% YoY to Rs 9 crore, Revenue up 33%.

Delhivery Q3 Results: Net loss widens to Rs 196 crore, revenue down 9% YoY.

Disclaimer: Views expressed in this content are strictly for educational purpose and do not provide any advice/tips on Investment or recommend any Buying or Selling any Stock. Admotag Finance neither take guarantee of profit nor stand responsible for any losses of any recipient. The recipient of this material should take their own professional advice before acting on this information.

2 thoughts on “Adani Enterprises Q3 Results: Company delivered Rs 820 crore profit vs Rs 12 crore loss YoY.”